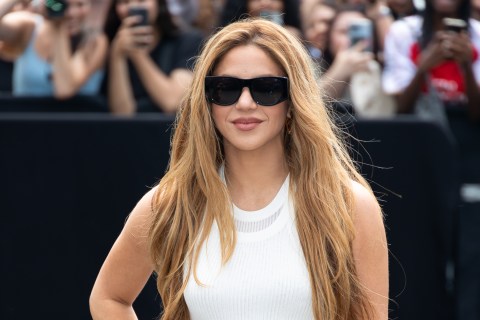

Shakira Has Settled Her Tax Fraud Case, Accepting A Suspended 3-Year Sentence And A €7 Million Fine

Shakira, the global pop sensation, recently resolved a prominent tax fraud case with Spanish authorities, accepting a suspended three-year sentence and a €7 million fine. The case centered on accusations that between 2012 and 2014, she neglected to pay 14.5 million euros in taxes. Despite holding official residence in the Bahamas, prosecutors contended that her considerable time spent in Spain warranted tax resident status. This legal saga shed light on the complexities of international tax obligations and the scrutiny faced by high-profile figures. The resolution marked a significant chapter in Shakira’s legal battles and emphasized the intersection of fame, finance, and the global legal landscape.

The potential consequences were severe, with Shakira initially facing the possibility of up to eight years in prison and a staggering fine of 24 million euros. However, the recently reached settlement has altered this trajectory, allowing her to avoid immediate incarceration unless she violates specific court-set conditions.

Throughout the legal dispute, Shakira consistently asserted her innocence, underscoring her dedication to ethical conduct and setting a constructive precedent. While reaching a settlement, she reiterated her conviction in her own innocence, clarifying that the resolution was chosen with her children’s well-being in mind.

In a lengthy statement, Shakira expressed her primary motivation for settling the case – her children. She stated, “I have made the decision to finally resolve this matter with the best interest of my kids at heart who do not want to see their mom sacrifice her personal well-being in this fight.” Interestingly, in July 2022, Shakira declined a plea deal, adding a layer of complexity to the case. The decision to initially reject the deal and later opt for a settlement raises questions about the factors that influenced her choices.

Shakira is not the only high-profile individual facing tax fraud allegations in Spain; others, including football stars Cristiano Ronaldo, Neymar, and Xabi Alonso, have encountered similar challenges. This broader context suggests a systemic issue with high-profile individuals navigating Spanish tax laws.

The crux of the case was the dispute over Shakira’s residency between 2012 and 2014. Prosecutors argued that Spain was her main residence, while Shakira asserted her official residence was in the Bahamas. Spanish tax law plays a pivotal role here, as spending more than six months in the country qualifies an individual as a resident for tax purposes.

The prosecution spotlighted Shakira’s purchase of a house in Barcelona in 2012, claiming it became the family home for her and her then-partner, Gerard Piqué. This real estate transaction played a crucial role in the allegations against Shakira. Interestingly, Piqué himself faced a substantial fine in a separate case for evading taxes between 2008 and 2010.

In an interview with Elle magazine in September 2022, Shakira claimed that her relationship with Spanish footballer Gerard Piqué triggered the tax authorities’ interest. She stated, “The Spanish tax authorities saw that I was dating a Spanish citizen and started to salivate. It’s clear they wanted to go after that money no matter what.” This narrative adds a layer of personal intrigue to the legal proceedings.

Despite facing legal hurdles, Shakira remains unwavering in her commitment to the future. Despite the stress and emotional toll of the legal battle, she has consistently expressed her determination to triumph over these challenges. Rather than succumbing to the pressures, Shakira has chosen to redirect her focus toward her family and burgeoning career. With an eagerly anticipated world tour on the horizon and a new album in the works, she is steadfast in channeling her energy towards constructive and positive endeavors, showcasing her resilience in the face of adversity.

Shakira’s resolution concludes a protracted legal feud that garnered global interest. The case not only unveils the complexities of global taxation but also prompts reflections on the toll of legal disputes on individuals, particularly those in the public spotlight. In her statement, Shakira didn’t shy away from criticizing the Spanish tax authorities. She claimed they pursued the case against her, as well as other high-profile individuals, draining their energy, time, and tranquility for years. This critique raises broader questions about the fairness and efficiency of the Spanish tax system, especially concerning international figures.

As Shakira anticipates her forthcoming ventures, the aftermath of this tax controversy is poised to influence both her personal and professional journey. The intricacies of the case, including the residency dispute, real estate transactions, and personal relationships, highlight the challenges individuals face when navigating complex international tax laws. Shakira’s choice to settle for the sake of her family underscores the personal toll that legal battles can take on individuals, even those with global fame and success.