Disney’s Evolution Under Bob Iger’s Leadership Captures Hollywood’s Attention

Hollywood is abuzz with speculation over the future course of action set by the Walt Disney Company, led by its Executive Chairman, Bob Iger. With discussions spanning from boardrooms in Culver City to executives in New York City, the media and entertainment industry’s leading figures are actively pondering the trajectory of this powerhouse conglomerate.

Iger Sparks Contemplation on Disney’s Core Businesses

In the midst of this excitement, Bob Iger sparked fervent discussions during a CNBC interview in mid-July, suggesting that Disney’s television enterprises, encompassing stations and cable channels, might not remain integral to the company’s core identity. This statement triggered a wave of analyses, with bankers and private equity players considering strategic moves in response.

“He’s signaling to investors,” remarked one anonymous banker, noting the impact of Iger’s words. “It starts people thinking.”

Further stoking the conversation, Iger elaborated on potential strategic partnerships for the company’s sports brand, ESPN, during Disney’s third-quarter earnings call. While maintaining that Disney planned to retain control, Iger hinted at notable interest from external parties.

Predictions and Speculations

Industry insiders have shared diverse perspectives on the potential direction of Disney. One executive proposed a spinoff of ABC broadcast network, local TV stations, and cable networks such as Disney Channel or FX into a separate, debt-structured entity. Another envisioned Disney spinning off its television assets as a publicly traded company, possibly with private equity involvement.

In the realm of sports media, speculations are rife about Disney attracting external investment for ESPN, enabling competitive bids for expensive sports media rights. This move could pave the way for Disney to fully own the streaming service Hulu, under an agreement that could come into play as early as January 2024.

Iger’s Strategic Vision: Learning from History

Drawing parallels from the past, experts liken Iger’s strategy to the one executed by former Time Warner CEO Jeff Bewkes. This strategy involves divesting portions of the company before ultimately selling its core units to larger entities. To appeal to potential buyers, the hypothesis is that Iger might aim to position Disney as a more focused and appealing acquisition target by shedding certain non-essential components.

Disney’s Multifaceted Growth Path

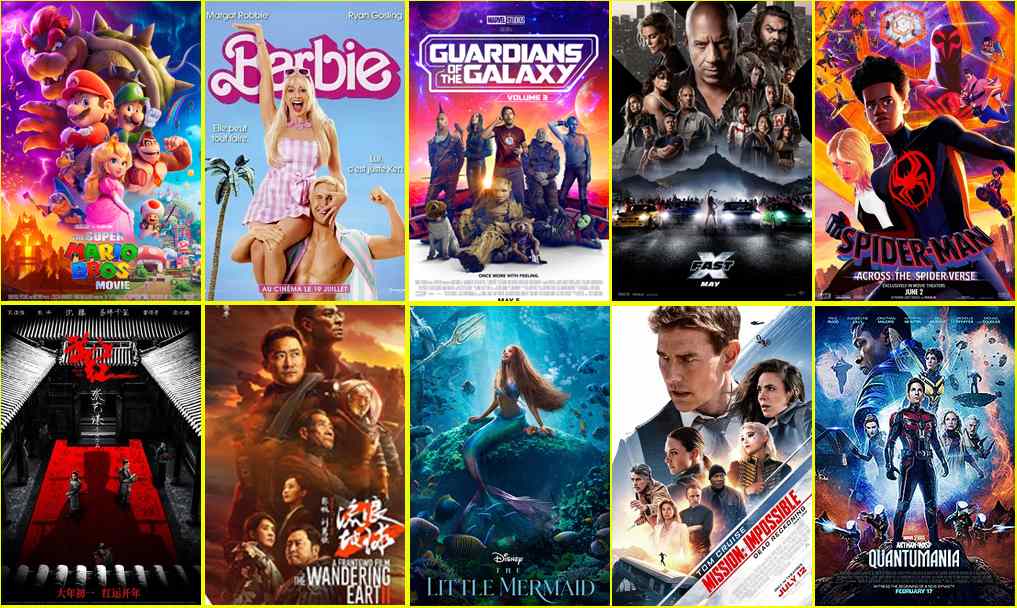

In contrast, Iger’s recent statements reflect a clear focus on Disney’s future growth areas. He identified three pivotal businesses expected to drive growth over the next half-decade: film studios, theme parks, and streaming video. By concentrating on these segments, Disney aims to leverage its iconic brands and franchises to create long-term value.

Strengthening the Core Foundations

Addressing analysts during the Q3 2023 earnings call, Iger highlighted the substantial transformations achieved since his return to Disney. He underscored the restoration of creativity at the heart of the business, streamlined operations, and cost-effective improvements. The company’s pursuit of profitability in the direct-to-consumer (DTC) sector also drew attention, with Iger noting a significant improvement in DTC operating income.

Streaming and Synergy

Disney’s evolving streaming strategies were spotlighted. Iger emphasized rationalizing content volume, improving user experiences, and deploying technology to optimize economics. He disclosed plans to unify user experiences across Disney+ and other platforms, enhancing engagement and user retention.

ESPN’s Prospects and Beyond

Iger touched on the potential direct-to-consumer approach for ESPN, affirming that it’s a matter of “when” rather than “if.” The company is actively exploring partnerships, technology, marketing, and content opportunities that allow it to retain control over ESPN while capitalizing on emerging trends.

Expanding Parks and Experiences

Disney’s enduring strength in its parks and experiences segment was also highlighted. With expansion plans for new themed lands and additional cruise ships, Iger underlined the global appeal of Disney’s brands and franchises. The company’s Asia parks displayed robust recoveries, indicating continued growth opportunities.

Strategic Film Studio Approach

The film studio segment came into focus, with Iger emphasizing a focus on quality and economics. By concentrating on significant franchises and tentpole films, Disney seeks to maximize the value of its content across various distribution windows.

Conclusion: A Confident Outlook

In the face of near-term challenges, Iger conveyed his unwavering optimism about Disney’s future. The company’s robust intellectual property foundation, its emphasis on creative excellence, and its outstanding talent pool all contribute to his positive outlook. As Disney navigates its evolving landscape, it remains committed to its iconic brands and franchises, poised for a future of growth and innovation.